Decoding the Secrets of Fibonacci Retracements: How They Impact Your Forex Strategies on MT4

Decoding the Secrets of Fibonacci Retracements: How They Impact Your Forex Strategies on MT4

Welcome to the fascinating world of trading and technical analysis ! If you’re a novice trader or even an experienced one, you’ve probably heard about Fibonacci retracement levels. These mystical-sounding levels are not some magical incantations, but rather powerful tools that traders use to decode the language of the financial markets. In this article, we’ll take a deep dive into the world of Fibonacci retracement levels . We’ll unlock the secrets behind these levels, exploring what they are, how they are calculated, and most importantly, how they can guide you in your trading journey.

Table of Contents

- What Are Fibonacci Retracement Levels?

- How Are Fibonacci Retracement Levels Calculated?

- How Traders Use Fibonacci Retracement Levels

- Conclusion

- FAQ’s

- 1. Are Fibonacci retracement levels foolproof?

- 2. Can Fibonacci retracement levels be used in any financial market?

- 3. Do I need to be a math whiz to use Fibonacci retracement levels?

- 4. Are there variations of Fibonacci retracement levels?

- 5. What other technical indicators complement Fibonacci retracement levels?

- Related posts:

Disclaimer: This post includes affiliate links

If you click on a link and make a purchase, I may receive a commission at no extra cost to you.

What Are Fibonacci Retracement Levels?

Imagine you’re on a treasure hunt and stumble upon a map with intricate lines and numbers. That’s essentially what a Fibonacci retracement chart looks like. It’s a map that traders use to navigate the complex terrain of price movements in financial markets. These levels are derived from a mathematical concept known as the Fibonacci sequence , which dates back to the 13th century and was introduced by the Italian mathematician Leonardo of Pisa, also known as Fibonacci.

The Fibonacci Sequence

Let’s start with the foundation of it all – the Fibonacci sequence. It’s a numerical series where each number is the sum of the two preceding ones. It begins with 0 and 1 and goes like this: 0, 1, 1, 2, 3, 5, 8, 13, 21, and so on. This sequence forms the basis of Fibonacci retracement levels.

How Are Fibonacci Retracement Levels Calculated?

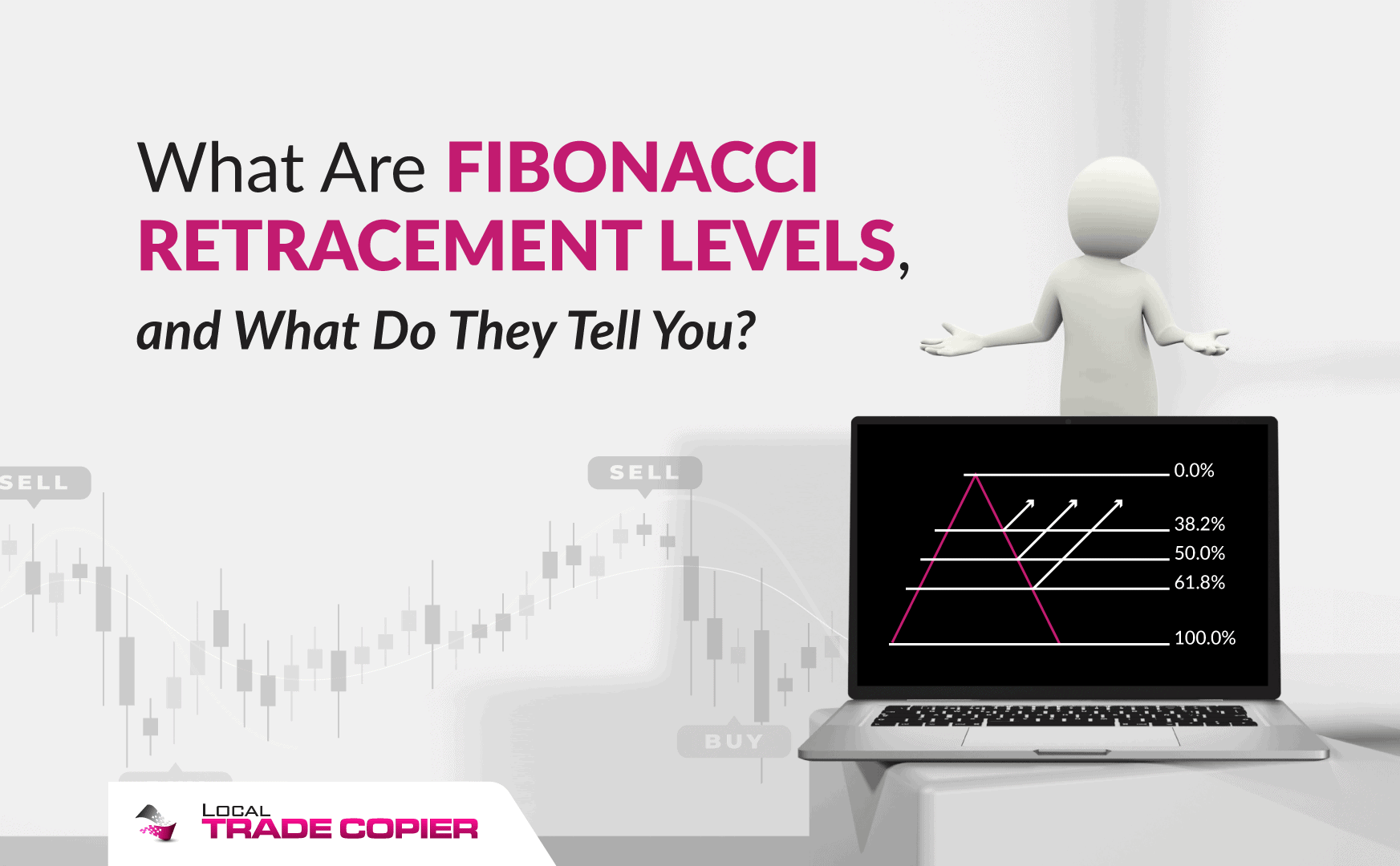

Now that you have a glimpse of the backstory, let’s dive into the nitty-gritty of how these levels are calculated. The key to unlocking Fibonacci retracement levels lies in identifying the high and low points of a price movement. Once these points are determined, you can start drawing horizontal lines on a price chart to reveal potential areas of support and resistance. These lines are represented as percentages, and the crucial retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 100%.

The Key Fibonacci Retracement Levels

- 23.6%: This level marks a shallow retracement and is often seen as the first line of defense for a trend. Think of it as a subtle hint from the market.

- 38.2%: The 38.2% level is like a guard dog, barking louder to warn you of potential reversals or corrections within a trend.

- 50%: While not a Fibonacci number itself, the 50% level carries psychological significance. It’s like a checkpoint on your trading journey, a moment of reflection for the market.

- 61.8%: Ah, the “golden ratio.” This level is considered a treasure trove for traders. When the price retraces to 61.8%, it often indicates a significant turning point.

- 100%: The 100% level is like a full circle, indicating a complete retracement of the prior move, suggesting a return to square one.

How Traders Use Fibonacci Retracement Levels

Now that you know these levels, let’s explore how traders put them into action.

Identifying Support and Resistance

Think of Fibonacci retracement levels as the secret codes on a treasure map. When the price retraces to one of these levels and bounces off, it’s like finding hidden treasure. Traders use these levels to identify strong support or resistance areas .

Confirming Trends

Traders rarely rely on a single tool. Fibonacci retracement levels are often used alongside other technical indicators to confirm the direction of a trend. When a retracement aligns with an existing trend, it’s akin to finding multiple clues that lead you in the same direction.

Managing Risk

In the world of trading,risk management is paramount. Traders set stop-loss orders just below key Fibonacci retracement levels to limit potential losses. Conversely, they may set take-profit orders near these levels to secure profits. It’s like using a compass to stay on course and a life jacket to stay afloat.

Conclusion

In the vast sea of financial markets, Fibonacci retracement levels act as a reliable compass, guiding traders through treacherous waters. They may not be magical, but they are powerful tools that help traders make informed decisions. Armed with the knowledge of these levels, you can better understand price movements, identify potential turning points, and ultimately, improve your trading strategies.

FAQ’s

1. Are Fibonacci retracement levels foolproof?

Ans. No, they are not foolproof. While they are incredibly useful, traders should always use them in conjunction with other indicators and risk management strategies.

2. Can Fibonacci retracement levels be used in any financial market?

Ans. Yes, they are versatile and can be applied to various financial markets, including stocks, forex, cryptocurrencies, and commodities.

3. Do I need to be a math whiz to use Fibonacci retracement levels?

Ans. Not at all. Most trading platforms offer tools to draw Fibonacci retracement levels automatically, making it accessible to traders of all backgrounds.

4. Are there variations of Fibonacci retracement levels?

Ans. Some traders use extensions of the retracement levels, such as 161.8% and 261.8%, for more precise analysis.

5. What other technical indicators complement Fibonacci retracement levels?

Ans. Popular indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can be used alongside Fibonacci retracement levels for comprehensive analysis.

Related posts:

- Elliott Wave Theory: What It Is and How to Use It

- Top 8 Forex Indicators That Every Trader Should Know

- Popular Forex Trading Strategies For Successful Traders

- How to use trend lines in Forex trading?

Also read:

- [New] Navigating Mac's Best Screen Capturing Apps & Tech for 2024

- 2024 Approved A Full Analysis of the Lightroom Application for Android

- 安全に初期設定を行い、データ保護を最優先: Windows 11の新しいセットアップへの挑戦方法

- 使用Windows 11兼容性檢查器選擇最適合的工具和設置

- 移動Windows 11中的附件到本地計算機 - 最佳方法

- Cloning Your PC Setup on Windows 11 - No Need to Reinstall!

- Easy Tips for Successfully Refreshing Your Chromecast Firmware

- Guía Paso a Paso: Clonar El Entorno De Inicio en Windows Ninja Para Evitar La Pérdida De Información

- In 2024, Can Life360 Track You When Your Apple iPhone 11 is off? | Dr.fone

- Maximize Fun Choose From Here's Top 5 Chrome Extensions for Facebook Vids for 2024

- Soundscape Sanctuary Free High-Resolution DJ Videos Available

- Transformer Gratuitement Un Fichier WebM en Format MP4 - Conversion Facile Avec Movavi

- Title: Decoding the Secrets of Fibonacci Retracements: How They Impact Your Forex Strategies on MT4

- Author: Stephen

- Created at : 2025-03-01 04:33:52

- Updated at : 2025-03-03 21:30:06

- Link: https://win-extraordinary.techidaily.com/decoding-the-secrets-of-fibonacci-retracements-how-they-impact-your-forex-strategies-on-mt4/

- License: This work is licensed under CC BY-NC-SA 4.0.